Gross income of an employee does not include amounts paid or expenses incurred by the employer for educational assistance to the employee if the assistance is furnished pursuant to a program which is described in subsection b. 127 a Exclusion From Gross Income.

Notes Law Of Taxation Pdf Excise Taxation

Section 1273b for Tier 1 and value added income incentives via a gazette order.

. 1274-6 with effect in accordance with Sch. Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for. S Sarvana Kumar a partner in Lee Hishammuddin Allen Gledhill said Section 127 3A of the Income Tax Act 1967 must be removed to avoid issues of abuses of the tax law.

Cessation of exemption 128. Promotion of Investments Act 1986. This is in line with Practice Note No.

B 6 23 of the taxpayers income for. Income Tax 5 Section 23. Section 1273A for Tier 2 3 via an approval from the Ministry of Finance.

4 of the amending Act by Finance Act 2011 c. Basis period to which gross income from a business is related. There are changes that may be brought into force at a future date.

Interpretation of sections 24 to 28 24. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Speaking to reporters on the sidelines of a tax seminar Sarvana said Sections 1273 and 127 3A both allow the finance minister to give tax exemptions.

The Income Tax Accelerated Capital. Following sections of the Income Tax Act 1967. X Acquisition of green assets which have been fully or partially funded by.

Cessation of exemption 128. Recently a Labuan company taxpayer successfully obtained leave to apply for an order for the Minister of Finance MOF to exercise his power under Section 135 andor Section 1273A of the Income Tax Act 1967 ITA to set aside or exempt the disputed notices of additional assessment raised by the Director General of Inland Revenue DGIR. CBDT Notification No.

Procurement of raw materials components and finished products. Namely that the qualifying company has been granted any exemption under section 127 of the Income Tax Act ITA has been clarified by replacing the reference to the section 127 of the ITA with a reference to an exemption granted under section 1273b or section 1273A of the ITA. General management and administration.

1271 For the purposes of sub-section 1 of section 282 the addresses including the address for electronic mail or electronic mail message to which a notice or summons or requisition or order or any other communication under the Act hereafter in this rule referred to as communication may be delivered or transmitted shall be as per sub. Power to transfer cases Section 1271 of Income Tax Act. New subsection 1273A is introduced by Act 644 of 2005 s25b deemed to have come into operation on 1.

Business planing and co-ordination. The revised guideline is available on MIDAs website wwwmidagovmy Resources Forms and. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the lesser of.

INCOME TAX ACT 1967. Income Tax Act 2007 Section 127 is up to date with all changes known to be in force on or before 17 February 2022. C has made a claim for a reinvestment allowance under Schedule 7A.

Non-chargeability to tax in respect of offshore business activity. B is exempt from tax on its income under Section 54A Paragraph 1273b or Subsection 1273A. 127 a 1 In General.

Incentive under the Section 1273A Income Tax Act 1967 or Selected Industries under Section 4D Promotion of Investment Act 1986 and plans to undertake the sameother qualifying. S Saravana Kumar a partner of Lee Hishammuddin Allen Gledhill LHAG said Section 127 3A of the Income Tax Act 1967 ITA must be removed to avoid issues of abuses of the tax law. The High Court also granted a stay.

1271 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter applies or tax for any previous year of assessment remaining unpaid and those regulations may in particular and without prejudice to the generality of the foregoing include. The reference to Section 127 of the Income Tax Act 1967 ITA under the non-application proviso is to be replaced with Paragraph 1273b and Section 1273A of the ITA. This is incentives such as exemptions under the provision of paragraph 1273b or subsection 127 3A of ITA 1976 which is claimable as per government gazette.

Speaking to reporters on the sidelines of a tax seminar here Saravana said Sections 1273 and 127 3A both allow the finance minister to give tax exemptions. PUA 1132006 Income Tax Act 1967 subject to different asset under each incentive. The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after.

Remission of tax 129 A. In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976. Exemptions from tax general.

Act but subject to section 127A any income specified in Part I of Schedule 6 shall subject to this section be exempt from tax. D has made a claim for deduction in respect of an approved food production project under the. Subject to this section income tax charged for each year of assessment upon the chargeable income of a person who gives any loan to a small business shall be rebated by an.

History Subsection 1271 is amended by Act 608 of. Deleted by Act 451. A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and.

1273A substituted 1972011 for s. 22018 dated 1 June 2018 issued by the Inland Revenue Board. Section 1273A exemptions given directly by the Minister of Finance usually via a letter to the taxpayer.

All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act 1890. 283E-In exercise of the powers conferred by clause d and clause e of proviso to clause 5 of section 43 and section 282A read with section 295 of the Income-tax Act 1961 43 of 1961 the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules 1962 namely-.

Know When To Say No To Cash Transactions Income Tax Act

Penalties Under Income Tax Act 1961

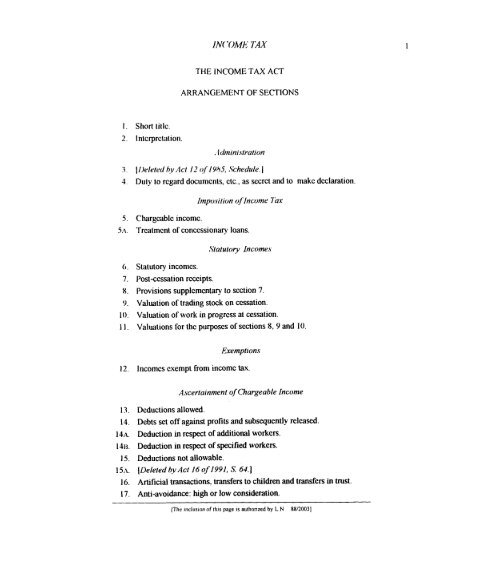

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Pdf Taxation Laws I Introduction To Income Tax Megan Grace Tabigue Academia Edu

Ncer Tax Incentives Ntax Ncer Northern Corridor Economic Region Ncer Malaysia

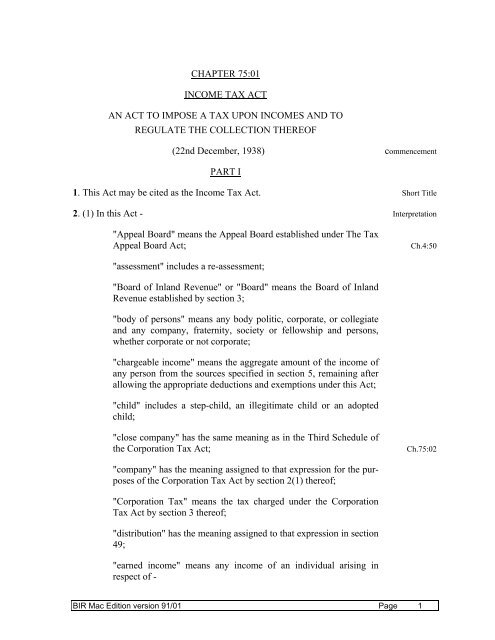

Chapter 75 01 Inland Revenue Division

Notes Law Of Taxation Pdf Excise Taxation

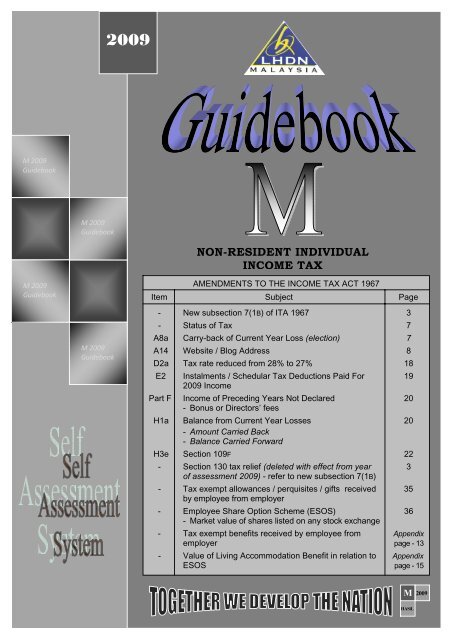

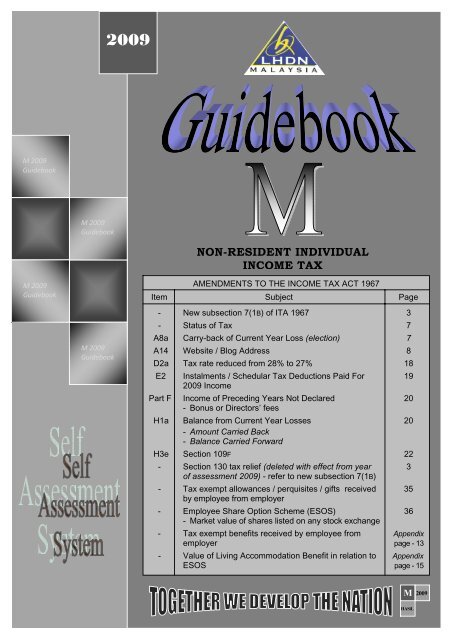

Non Resident Individual Income Tax Lembaga Hasil Dalam Negeri

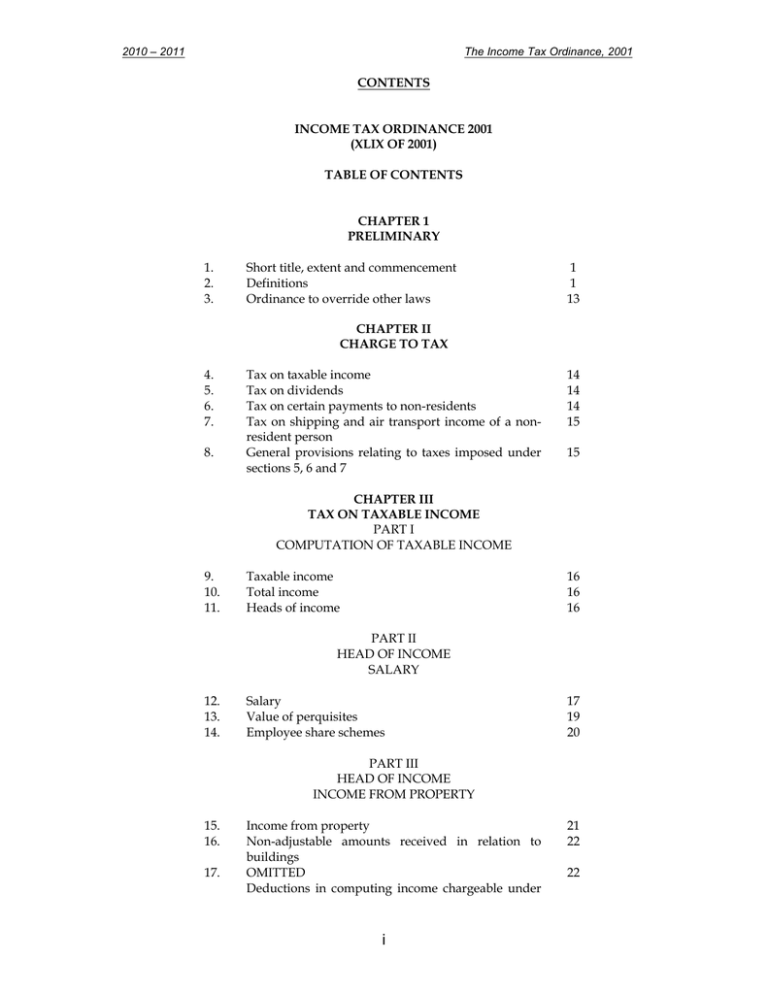

The Income Tax Ordinance 2001 Up To July 2010